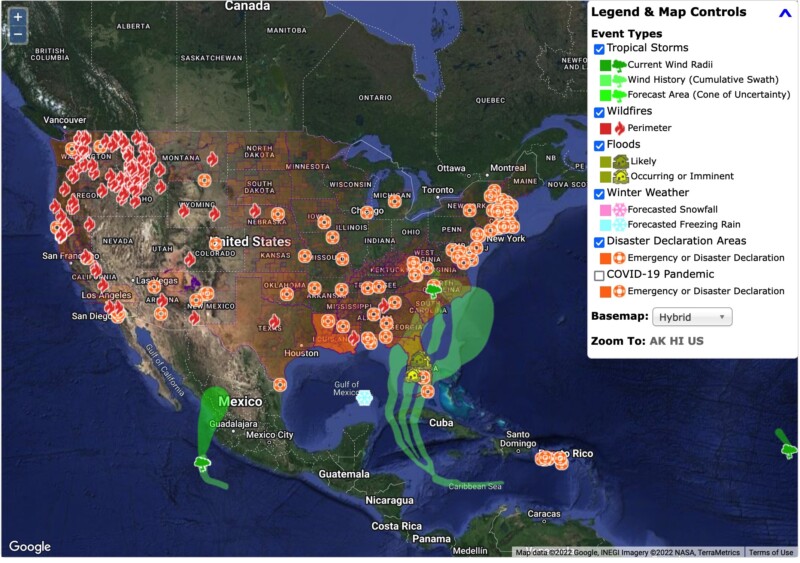

Hurricane Ian is just the latest in a series of disasters that have hit the US over the past few years. The map below, from the US Census Bureau, shows a summary of storms, floods, wildfires and other disaster declaration areas. More information and map tools are here.

Implications

If you have not been affected by a natural disaster, fire or flood, it is probably just a matter of time until it happens in your area. Ready.gov offers helpful information on how to prepare yourself and your family for potential disasters and emergencies.

In addition, it is important to consider similar steps to protect your practice infrastructure from various types of catastrophic events. It is important to have the following in place:

Insurance coverage

This is a good time to review your business premises insurance coverage and consider updating or adding to your policy.

Most standard insurance policies have an exclusionary clause stating that they don't pay for loss or damage due to extraordinary events such as war, riots, hurricanes, earthquakes and the like. In some areas you can purchase separate flood or hurricane insurance.

Damages such as flooding from a water leak or fire from an electric spark, are typically covered in a basic policy. Check yours to make sure. In addition to compensation for damaged furniture and equipment, you may also want to consider the following:

- Business interruption insurance: If your office needs major renovation after a catastrophe, you may not be able to see clients in person for several weeks. Business interruption insurance pays some or all of your missed income.

- Paper records coverage: A fire or flood can destroy or damage important paper records. This type of insurance helps defray the cost of recovery and restoration.

- Cybersecurity: This is a concern at all times, but when there is disruption in the system from weather, fire, earthquakes, etc., you may be at greater risk for a data breach. Make sure your policy includes coverage for responding to a data breach (as required by HIPAA).

Off-premises record storage

- Physical records: For paper contracts, hand-written notes and other non-electronic data, it's a good idea to make copies and store them in a secure place at a different physical location. Of course, you need to take special care to protect confidentiality of any records that contain client information.

- Electronic records: If you store your records on your computer, you know that it's important to back up on a regular basis. But if you are only backing up to a local hard drive next to your computer, and your office is destroyed by a fire, the backup data on the hard drive may not survive.

As a preventive strategy, consider subscribing to a secure cloud backup service that works continually in the background. That way, if you do have an unexpected data loss, your cloud backup will be up to date except, perhaps, for changes during the last hour that you used your computer.

In addition to (or instead of) cloud backup, some mental health professionals use two or more hard drives to back up data, alternating the drives for each backup and always keeping a recent backup off-premises.

Professional services backup

If you are unable to see clients (even online) for several weeks, due to injury or to family concerns, some clients may not be able to wait. Thus, consider arranging with a colleague to see them in the meantime.

Get written permission from the client to allow your colleague access to the client's records. Also have a written agreement with your colleague regarding client payment. You may need to take into account that one of you takes insurance and the other does not, or that there is a difference in your fees.